Most Loved Household Brands of 2025

Data

16 / 10 / 25

You can almost hear the collective groan across the UK’s weight loss forums: “Mounjaro’s gone up again?”

A few months ago, Eli Lilly’s golden child of the weight loss world was untouchable.

It was the category leader, the name everyone Googled, the brand that could do no wrong. Then came the price hikes, and suddenly the conversation shifted.

The market didn’t collapse. It pivoted.

Because when the leader raises prices, something predictable happens: people start searching for alternatives. And those searches have a name — Wegovy.

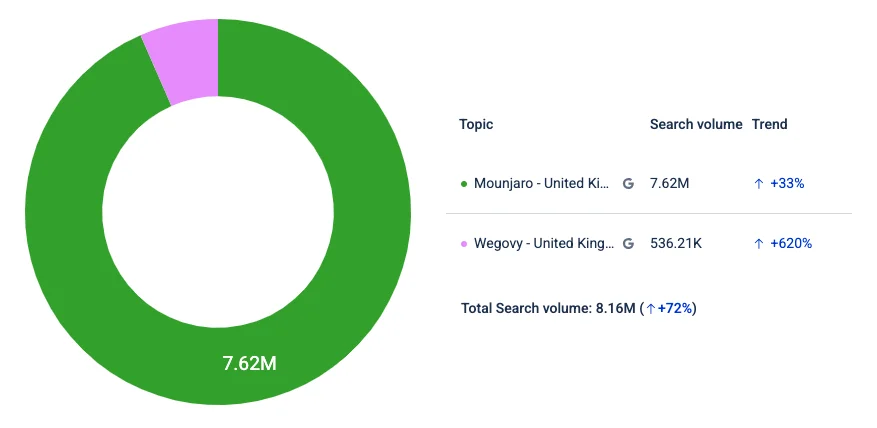

According to My Telescope’s UK search data, the story between June and August 2025 is as clear as a bar chart in a boardroom.

But Mounjaro’s share of search has dropped.

Wegovy’s share of search has jumped from 6.6% to over 10%, while Mounjaro’s has slipped from 93% to 89%.

That might not sound dramatic until you realise this is happening in a matter of weeks, not years. In search terms, that’s a full-blown momentum swing.

And the catalyst isn’t innovation or new marketing. It’s price.

The thing is, we know that Share of Search is a leading marketing indicator.

So that tells us that Mounjaro may lose sales in the future.

The search data is confirming this.

People are going to move to Wegovy. For Wegovy, that’s brilliant news.

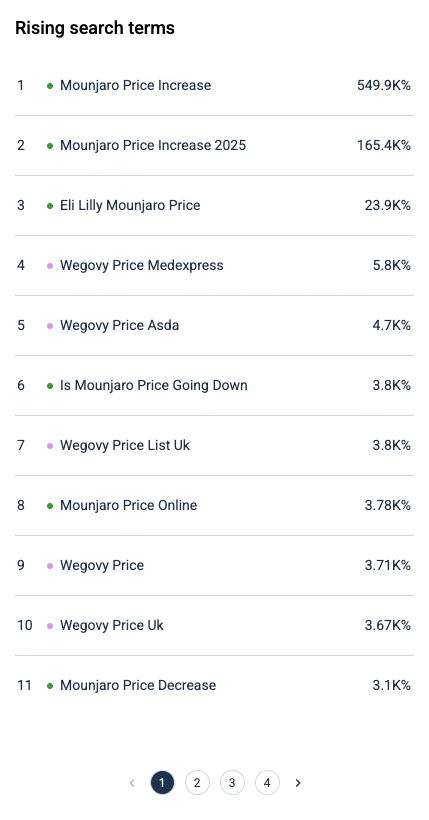

“Mounjaro price increase” isn’t just a trending term — it’s the top rising search in the entire category, up by an absurd +549,900%. That’s not consumer curiosity; that’s a collective panic click.

Right below it:

And then, right where you’d expect them, the follow-ups:

The market isn’t subtle. Consumers are literally typing their intent. They’re not browsing out of idle curiosity; they’re shopping around.

That’s not brand erosion — that’s brand opportunity, and it doesn’t belong to Mounjaro.

Here’s the thing about being the category leader: every move you make sends ripples through the entire market. Mounjaro’s decision to raise prices might make sense operationally. Tighter supply, higher costs, sustained demand and moving the UK in line with the rest of the world.

Sure.

However, every one of those justifications resides within the company.

Consumers, however, live outside of it.

And outside, price hikes translate into friction, and friction creates search.

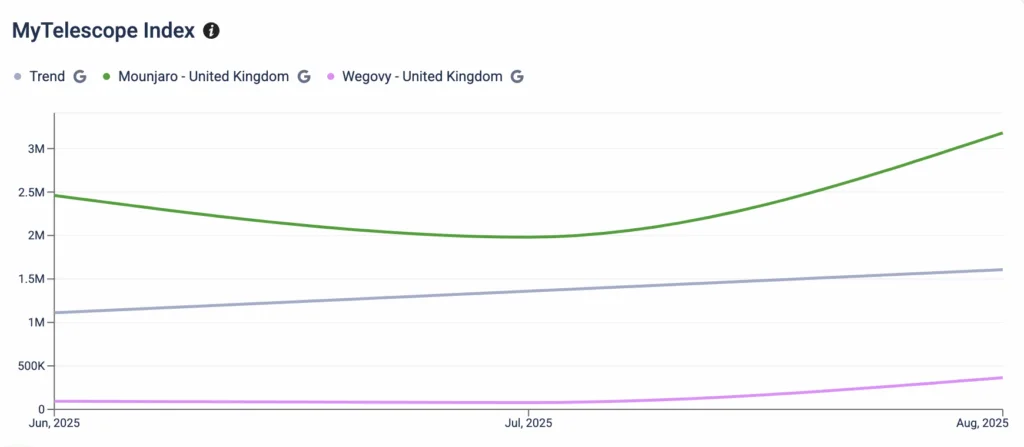

Look at the trend lines from My Telescope’s three-month view.

In June, Mounjaro’s interest was nearly ten times that of Wegovy. By August, the gap had narrowed sharply. Wegovy’s curve is pointing up like a rocket.

What’s happening isn’t random. It’s the “halo of substitution”.

When consumers are exposed to one brand’s bad news, they start looking at others in the same category.

Mounjaro’s visibility created a rising tide and Wegovy is surfing it.

Marketers love to talk about “real-time consumer insight.” But most of the time, that means a dashboard full of vanity metrics.

Search data, when read properly, is the real window into behaviour.

Here’s what the My Telescope data tells us:

In other words, the data doesn’t just show interest.

It shows opportunity forming in real time.

For Wegovy, this is the moment most brands wait years for.

They didn’t have to out-spend or out-innovate. They just had to be there when the market leader aggressively changed prices.

With its 365% search growth and 180% increase in share of search, Wegovy is enjoying the rarest kind of marketing tailwind, borrowed relevance.

Consumers are discovering the brand not through awareness campaigns but through comparison searches, pricing curiosity, and category switching. That’s the perfect foundation for amplification.

So what should Wegovy and the smart marketers around it do now?

If Wegovy treats this moment as a signal rather than a spike, it can lock in a meaningful share of salience before Mounjaro adjusts its strategy.

There’s a broader lesson here, one that extends far beyond the world of weight loss jabs.

Every pricing move is also a brand move.

Marketers often separate the two: pricing is for finance, brand is for comms.

Consumers don’t separate them at all.

The minute you change what they pay, you change how they perceive you.

Mounjaro’s leadership position gave it the confidence to raise prices. But leadership comes with visibility, and visibility means vulnerability. When consumers feel squeezed, they look around.

That’s how category disruption really happens, not with a fancy campaign or influencer partnership, but with a single question typed into Google: “Is there a cheaper one?”

And once they type that, the game changes.

This is where My Telescope’s data earns its keep.

Because it doesn’t just show what people are saying, it shows what they’re searching for. It reveals the cracks before they appear on the sales chart.

The data shows that even though Mounjaro remains dominant, its lead is no longer guaranteed. Search volume is a leading indicator of future demand.

If Wegovy keeps converting its search gains into actual buyers, this market could look very different by Christmas.

And the brands watching those curves, not the headlines, will be the ones ready to act.

The moral here isn’t that Mounjaro made a mistake. It’s that markets are mercilessly dynamic.

One brand’s tactical decision can become another’s strategic opportunity overnight.

Wegovy didn’t cause Mounjaro’s price problem. But it’s positioned to benefit from it… if it acts fast. Because momentum, like market attention, doesn’t last forever.

So here’s the uncomfortable truth for every marketer.

While you’re obsessing over your next campaign, your competitors are reading the same search data you’re ignoring and using it to eat your lunch.

Because search data tells us stories about how our marketing and business decisions will impact our future.

Ensure you understand what your search data is.

Andrew Holland

All insights and trend figures referenced in this article are derived from My Telescope’s UK Search Data (June–August 2025), analysing brand-specific search volume, share of search, and rising term performance for Mounjaro and Wegovy.

This post was created with the assistance of MyTelescope. JBH is working with MyTelescope, a data analytics SaaS platform that allows you to understand the real meaning behind search data. Together JBH and MyTelescope will be pulling back the curtain on the worlds search data, providing insights every month

https://www.mytelescope.io/