Digital PR Isn’t Link Building. It’s the Most Profitable Channel You’re Ignoring

Digital PR

From cleaning sprays that make your sink sparkle to the snacks fuelling your late-night doom scroll, some brands have achieved true cult status in British homes this year.

To find out which brands are winning hearts in 2025, the JBH team analysed UK favourites across three key sectors: Cleaning & Homecare, Food & Beverage, and Health & Wellness.

Focusing on socially driven, TikTok-fuelled brands (and a few household classics for comparison), the research combined search trends, social buzz, and Trustpilot reviews which gave each brand a score out of 50, revealing which names truly resonated with consumers this year.

With 37% of Brits admitting they’ve dropped once-loved brands, loyalty is shifting fast, and these results show who’s capturing attention, and who’s losing it.

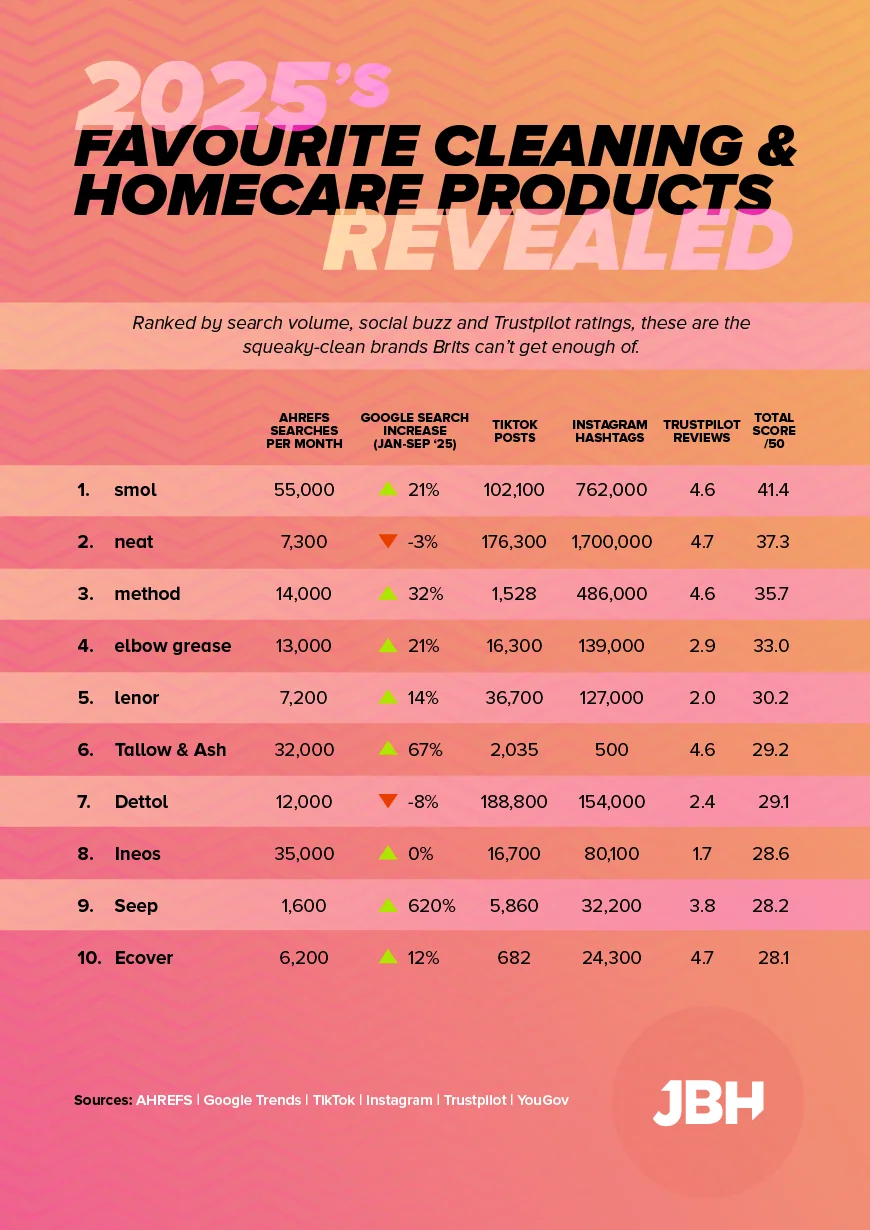

Once seen as a chore, cleaning has evolved into a lifestyle choice, and in 2025, the Mrs Hinch effect lives on, but with a more mindful, eco-conscious twist. Today, it’s the planet-first brands that are truly taking centre stage.

smol tops the category with a score of 41.4 out of 50. Launched in 2018 with a mission to reduce waste and harsh chemicals, smol began with dishwasher tabs and laundry pods and has since expanded into cleaning sprays, toothpaste, and hand wash. Originally an subscription-only brand, it’s now available at Sainsbury’s and on Amazon, but still pulls in around 55,000 average monthly Google searches.

In second place, neat. scores 37.3 out of 50. With more than 1.7 million Instagram hashtags and a 4.7 star Trustpilot rating, the refill-first brand’s stance against single-use plastics is clearly resonating. Its range is more streamlined than smol’s, but it’s now widely stocked in Tesco, Waitrose, Sainsbury’s and Booths. Google search interest dipped slightly between January and September this year, down by 3%.

method rounds out the top three with a score of 35.7 out of 50. The plant-based pioneer continues to grab attention with vibrant packaging and a strong ethos, racking up 486,000 Instagram hashtags and a 32% uplift in searches between January and September 2025. While method was born in the US (now owned by Ecover, which also appears in 10th place with 28.1 out of 50), both smol and neat. are British-based and manufactured brands.

Further down the list, laundry-only players diverge. Lenor places fifth (30.2 out of 50) but draws a low Trustpilot rating (2.0). Newcomer Tallow & Ash ranks sixth (29.2 out of 50), buoyed by 32,000 average monthly searches and a 4.6 Trustpilot score. The brand seems to be revolutionizing the laundry market, it’s detergents and softeners are designed alongside master perfumers, which may explain the strong interest and rating.

At the other end of the findings, Bio-D, The Lab Co., and Dr. Beckmann underperform with 10.7, 13.9, and 16.9 out of 50 respectively. The results reflect limited online momentum and weaker reviews. Dr. Beckmann, known for its specialist, high-performance stain solutions since 1982, shows relatively modest digital buzz (7,400 TikTok posts) and a 2.5 Trustpilot rating, proof that heritage alone isn’t enough to stay front-of-mind online.

Commenting on this, Jane Hunt, Founder of JBH says:

“We’re seeing a real shift in how people connect with cleaning brands. It’s no longer just about performance, it’s about how those products make your home feel.

“Platforms like TikTok have accelerated this, with independent brands tapping into ideas of calm, comfort, and care.

“By partnering with trusted home influencers and introducing eco-friendly products with softer, more natural scents, these brands are aligning themselves with a lifestyle that’s both sustainable and aspirational.

“It ties directly into the wider wellness movement, caring for the planet, as well as the spaces we live in. Ultimately, it’s about creating homes that feel warm, lived-in and beautifully cared for, and that emotional connection is what’s driving their success.”

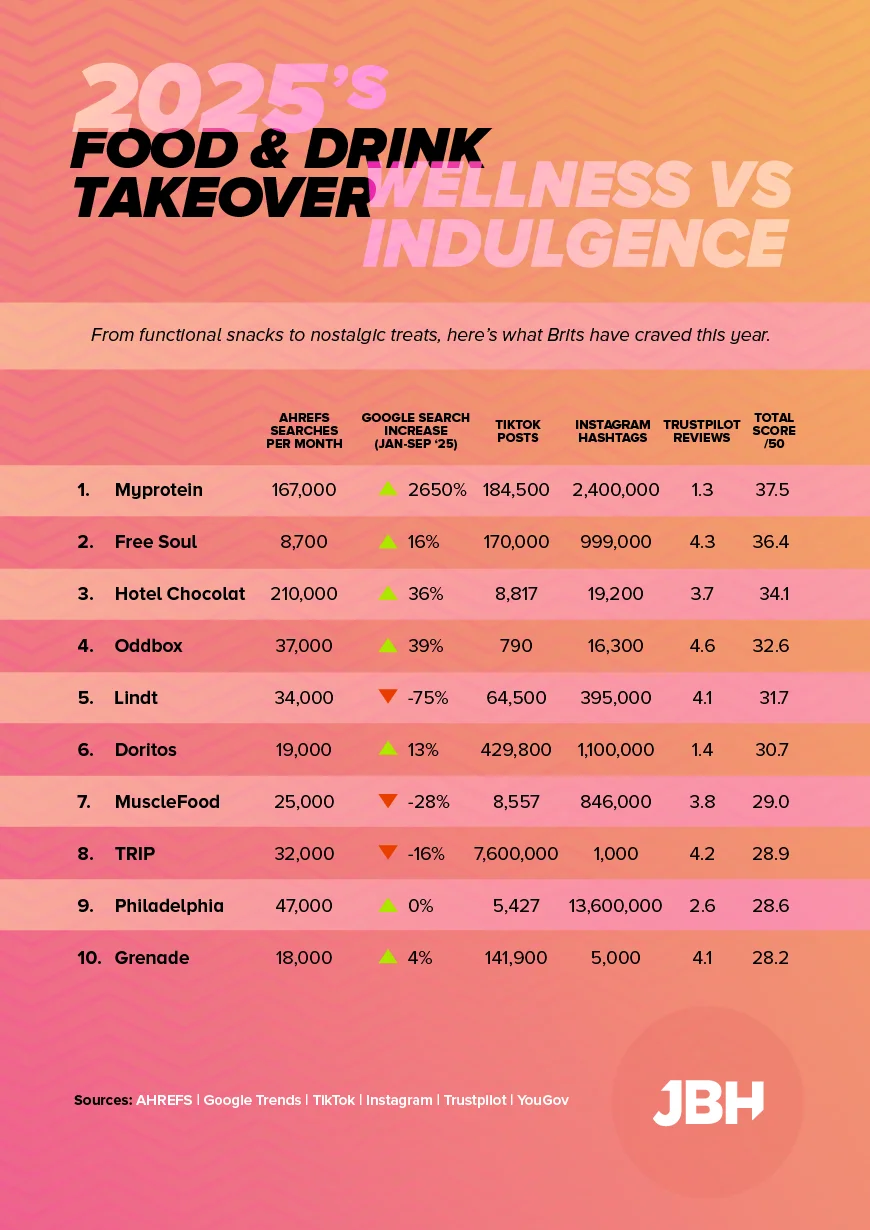

From protein powders to premium chocolate, Britain’s favourite food and drink brands prove that balance is back, blending health goals with everyday indulgence.

MyProtein leads the food and beverage pack with a score of 37.5 out of 50, bolstered by 2.4 million Instagram hashtags and 184,000 TikTok mentions. Despite a modest Trustpilot rating of 1.3, the brand’s scale and cultural relevance keep it front-of-mind for wellness-oriented consumers.

Close behind, Free Soul comes in second with a score of 36.4 out of 50. The women-focused nutrition brand is on the verge of hitting 1 million Instagram hashtags (currently at 999,000) and holds a 4.3 Trustpilot rating across a range that includes creatine, protein shakes, adaptogens and beauty gummies.

Rebecca Moss, Director of PR at JBH says:

“The data shows how closely wellness and enjoyment are now linked. Brands like MyProtein and Free Soul are leading the conversation because they’ve normalised health-focused choices without losing the sense of indulgence consumers still crave.

“Consumers no longer want to choose between feeling good and eating well, they expect both. This mindset is driving the success of brands that focus on nourishment, balance, and self-care rather than restriction.

“It’s also why traditional indulgence-led names are under pressure to show a clearer purpose and adapt to a more mindful way of living.”

In third, Hotel Chocolat boasts a solid score of 34.1 out of 50. While its TikTok presence is smaller, strong brand loyalty, over 200,000 monthly searches, and a 36% search increase between January and September, show it remains the go-to for affordable luxury. Its inclusive price ladder helps it outscore Lindt, which ranks in fifth place, 31.7 out of 50), following a 75% decline in searches over nine months.

At the bottom of the rankings, Rubicon Raw Energy lands 9.1 out of 50, with minimal social content and no Trustpilot rating, a tough position in a market dominated by lifestyle-led giants like Red Bull and Monster.

Shockingly, Tony’s Chocolonely also underperforms, scoring 14.4 out of 50. Despite strong brand recognition and eye-catching packaging, digital engagement has stalled in 2025, with fewer than 6,700 TikTok posts and just 1,000 Instagram hashtags. Whilst the brand’s focus on social impact remains commendable, and its Willy Wonka-esque still sets it apart, this data suggests its messaging may be resonating less with younger audiences.

Beauty and self-care have become cultural powerhouses, where expert-backed credibility meets influencer-driven hype to shape modern wellness.

BPerfect Cosmetics takes first with 37.1 out of 50. A near-perfect 4.9 Trustpilot score and rising online buzz suggests its accessible approach to glam continues to hit the mark. The brand champions inclusivity, its best-selling Chroma Cover Matte Foundation spans 35+ shades, resonating with makeup enthusiasts across the UK.

Taking the second spot is CeraVe, scoring 34.9 out of 50. The dermatologist-approved skincare staple remains a fan favourite, fuelled by over 415,000 TikTok posts and steady online buzz. While its Trustpilot rating of 2.9 suggests room for improvement, high search interest (73,000 monthly searches) and strong social engagement keep it firmly in the spotlight. A new multi-year partnership with the NBA is also set to boost brand awareness even further.

Rounding out the top three is Rare Beauty, Selena Gomez’s makeup brand, scoring 33.9 out of 50. Its message of self-acceptance and effortless beauty continues to resonate, with over 1.3 million Instagram hashtags and steady search interest despite rising competition.

Rare Beauty is the only other celebrity brand to feature in the top ten, outperforming Ariana Grande’s r.e.m. beauty and Mitchell Halliday’s Made By Mitchell, both of which maintain strong cult followings online.

Lower down, at the other end of the findings, Humantra scores 13.3 out of 50. Despite a 170% rise in search interest, engagement remains muted (590 TikTok posts; 1,000 Instagram hashtags) and the absence of Trustpilot reviews hampers trust beyond early adopters.

Just one spot above Humantra is cult SPF label Supergoop! with a score of 15 out of 50. Search volume for the brand fell 46% between January to September, suggesting UK attention may be shifting to newer or homegrown alternatives. While 41,100 TikTok posts and 84,700 Instagram hashtags show healthy chatter, the brand’s lower Trustpilot score of 3.2, indicates room for improvement.

Rounding out the three lower performers, Luna Daily scores 17 out of 50. A dramatic 2,600% surge in search interest since January hasn’t yet translated to social traction, with just 947 TikTok posts to its name, and fewer than 1,000 Instagram hashtags. In beauty, where live tests and peer reviews drive purchase decisions, sustained social awareness is key for brands to stay competitive.

Methodology: Most Loved Household Brands 2025

To identify and compare the most loved household brands across the cleaning, food & beverage, and health & wellness sectors in 2025, we developed a scoring framework combining search demand, consumer interest, social activity, and trust metrics.

1. Brand Selection: Our seed lists for each category were carefully curated using a wide range of trusted industry sources — including market reports, consumer press, and expert roundups — to ensure a balanced mix of established leaders and emerging challengers. Every effort was made to include all relevant brands within each category, reflecting the full breadth of the market.

Full seed lists are available to view [here].

2. Google Trends Analysis: UK Google Trends data (Jan – Sept 2025) was analysed to measure changes in search interest.

3. Search Demand (AHREFS): Monthly search volumes from AHREFS captured online visibility and demand.

4. Social Media Popularity: Social engagement was measured via:

These reflect each brand’s cultural relevance and engagement.

5. Consumer Trust & Reviews: Trustpilot review data was used to derive a score to reflect satisfaction and reliability.

6. Composite Scoring: All five dimensions (Google Trends, Search, TikTok, Instagram, Trustpilot) were normalised and aggregated to produce an overall Total Score (out of 50).

This composite framework delivers a balanced view of visibility, popularity, and trust, revealing which household brands are most loved in 2025.

Data correct as of 13/11/2025 and was collected between January 2025 to October 2025.